Adhd Tax

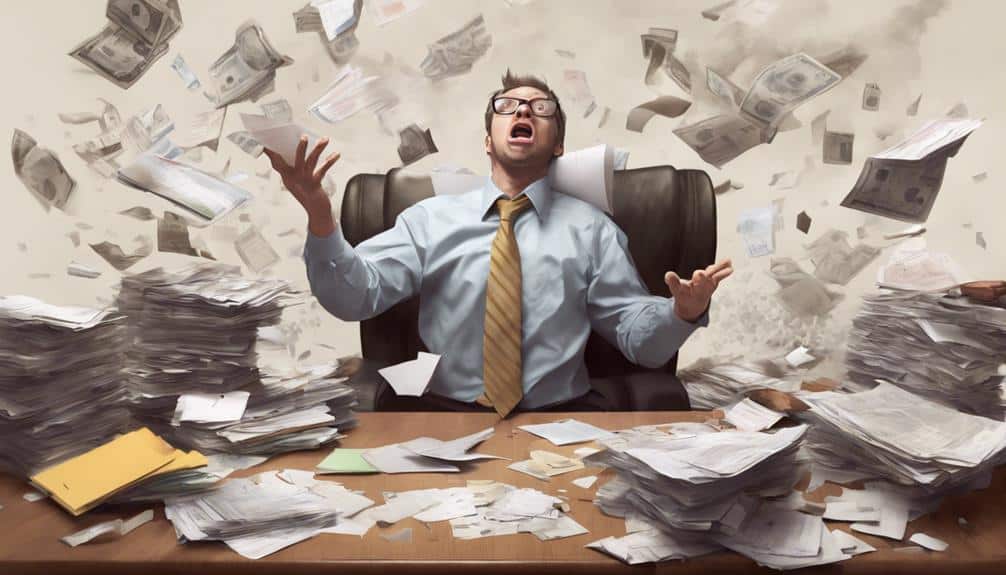

Ever heard of the 'ADHD Tax'? Let me tell you, it's no joke. The financial implications can be significant, impacting various aspects of daily life.

From missed deadlines to impulsive spending, individuals with ADHD face unique challenges that can take a toll on their wallets. But fear not, there are strategies and solutions to navigate this taxing terrain.

So, how can we guarantee a smoother financial journey for those affected by ADHD? Stay tuned for insights on managing the ADHD Tax and seeking financial wellness.

Key Takeaways

- ADHD Tax includes higher interest rates and financial strain.

- Daily challenges impact tasks, finances, and mental health.

- Strategies like automated payments and therapy help manage ADHD Tax.

- Seeking financial wellness involves routines, support, and reflection.

Understanding the ADHD Tax

In my experience, understanding the ADHD Tax involves recognizing the additional burdens faced by individuals with ADHD in managing their daily responsibilities. The ADHD Tax is draining, not only emotionally but also financially. The financial costs associated with ADHD can be significant, including higher interest rates on loans and credit cards due to impulsive spending or missed payments. These hidden costs can accumulate over time, further straining financial stability. Executive function challenges characteristic of ADHD can lead to difficulties in budgeting, keeping track of bills, and sticking to financial plans, exacerbating the financial impact of the disorder.

Reducing the burden of the ADHD Tax requires addressing these financial challenges through strategies such as setting up automatic bill payments, creating visual reminders for financial deadlines, and seeking professional assistance when needed. By understanding and actively managing the financial aspects of ADHD, individuals can alleviate some of the stress and uncertainty associated with the disorder, ultimately improving their overall well-being and financial health.

Impact on Daily Life

Managing daily life with ADHD presents a myriad of challenges, from forgetfulness and impulsivity to disorganization, impacting various aspects of functioning. These challenges extend beyond mere importance, often resulting in tangible financial costs.

Forgetting to pay bills on time can lead to late fees, missed discounts, or even damaged credit scores. Impulsive purchases, a common symptom of ADHD, can quickly accumulate and strain financial resources. Additionally, managing daily tasks such as grocery shopping or organizing belongings can become overwhelming, leading to time wasted and increased stress.

The mental health impact of constantly battling these challenges can further exacerbate the emotional toll, limiting personal freedom and hindering overall well-being. To navigate these difficulties effectively, it's important to develop strategies for managing the financial toll, establishing routines for daily tasks, and seeking support to address the emotional and mental health aspects of living with ADHD.

Financial Struggles and Costs

Handling the financial burdens of the ADHD tax requires proactive strategies and a keen awareness of its impact on daily expenses and stability. Financial struggles such as missed payments, impulsive purchases, and income instability can notably affect individuals with ADHD.

The challenges in controlling movements, prioritizing tasks, and managing work responsibilities often lead to financial instability, putting a strain on relationships and diminishing self-esteem. These struggles can create a cycle of stress and uncertainty, impacting one's overall quality of life.

To address these issues, creating budgets, setting reminders for payments, and seeking therapy are effective steps in managing the financial impact of the ADHD tax. By understanding the implications of the ADHD tax, individuals can develop coping mechanisms, establish routines, and leverage technology to enhance their money management skills.

It's essential to tackle these financial challenges head-on to improve financial stability and overall well-being.

Strategies for Managing ADHD Tax

To effectively navigate the challenges posed by the ADHD tax, individuals must proactively implement tailored strategies that address their unique financial needs and circumstances. Setting up automatic bill payments and reminders can help avoid late fees, while creating a structured daily routine and sticking to a budget are effective ways to mitigate the financial impact of ADHD challenges. Seeking therapy or counseling tailored for ADHD can provide coping mechanisms and support for managing the ADHD tax.

Utilizing technology such as budgeting apps and organizing tools can assist in better managing finances despite ADHD-related difficulties. Educating oneself about ADHD and its financial implications is key to developing personalized strategies for addressing the ADHD tax effectively.

- Therapy and Counseling: Offering coping mechanisms and support.

- Structured Routine: Providing stability and predictability.

- Budgeting Apps: Assisting in financial organization.

- ADHD Education: Understanding the condition's financial impact.

- Personalized Strategies: Tailoring approaches to individual needs.

Seeking Financial Wellness

Seeking financial wellness while managing ADHD involves optimizing treatment, addressing co-occurring conditions, and creating an ADHD-friendly lifestyle environment to support overall stability and financial health.

The emotional burden and financial strain associated with the ADHD tax can be overwhelming, making it important to seek financial counseling and therapy for support.

Establishing routines, utilizing reminders, and setting up budget plans are practical strategies to promote financial wellness and manage the challenges posed by ADHD.

Joining support groups and taking small consistent steps can assist in overcoming procrastination and linking financial decisions to future outcomes.

It is crucial to acknowledge the discomfort and reflect on the consequences of the ADHD tax to address and mitigate financial challenges effectively.

Frequently Asked Questions

Is ADHD Considered a Disability for Taxes?

Yes, ADHD can be considered a disability for taxes if it greatly limits major life activities. Tax deductions for medical expenses, work accommodations, therapy costs, and self-employment deductions may be available with proper documentation and qualification.

What Is the Neurodivergent Tax?

Understanding the Neurodivergent Tax is important for promoting inclusivity and support. Financial burdens, workplace accommodations, and stigma reduction are key. Advocacy for policy reform, mental health support, and education advocacy are essential for addressing income disparities.

Does ADHD Qualify for Disability Payments?

Yes, ADHD can qualify for disability payments based on the severity and impact on daily life. Meeting specific criteria, providing medical documentation, and seeking legal guidance are essential for financial assistance. Support networks and advocacy efforts can aid in the process.

Is ADHD a Disability for Federal Employment?

Yes, ADHD is recognized as a disability for federal employment. Individuals can receive accommodations like flexible schedules and assistive technology to address workplace challenges. The accommodation process verifies equal rights and support for improved job performance.

Conclusion

In conclusion, tackling the ADHD Tax can feel like a constant battle, but with the right tools and strategies, it's possible to minimize its impact on our finances and daily life.

By staying informed, seeking support, and implementing proactive measures, we can take control of our financial wellness and work towards a brighter future.

Remember, Rome wasn't built in a day, and neither is financial stability – but every small step forward counts.